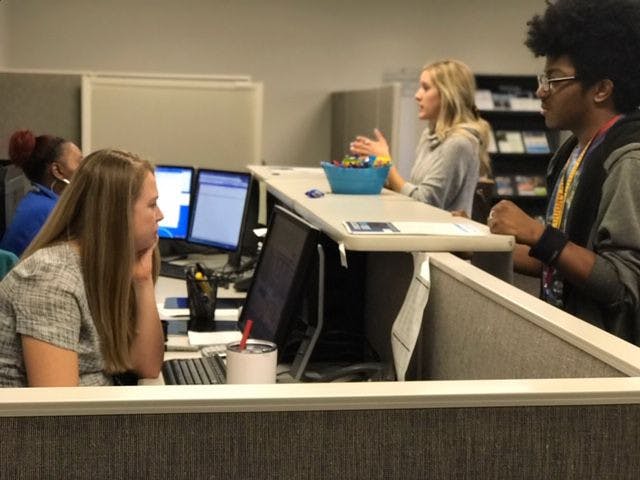

University of Memphis FAFSA employees assist students with questions about their financial aid status. The government's shutdown has affected students who require forms of verification for their FAFSA.

The government shutdown could delay the processing of some University of Memphis students’ financial aid funding.

On Dec. 21, 2018, President Donald Trump met with Congressional lawmakers and proposed funding for the new wall along the United States-Mexico border. No agreement was made during the meeting, which prompted the government to shut down the following day.

The shutdown has made government employees unable to recieve pay and all IRS documents to be withheld.

Karen Smith, the director of financial aid at the UofM, said students who require a form of verification could be affected.

“Students who are randomly selected for verifications by the U.S Department of Education would be impacted by the shutdown,†Smith said. “They are not able to use the IRS data retrieval tool to get tax information sent to our school.†Â

The IRS data retrieval tool allows students to request tax transcript information based on the year. However, since the government is not providing any information regarding those documents, people may be unable to recieve financial aid grants.Â

Smith said there may be a temporary solution for students until lawmakers and the president come to an agreement.

“We’re looking at all the students who are enrolled, and we also ran a report on all the students who are in that situation,†Smith said. “We currently have around 200 students and will look to see what they’re potentially eligible for, in terms of grants or loans.â€

After sorting through students’ information, Smith and her co-workers will notify them about a temporary hold on their classes.

Smith understands how these unforeseen circumstances have put a strain on students.

“I think it’s frustrating for everyone because a lot of people don’t know when there is a government shutdown and how it impacts people in different ways,†Smith said. “Unfortunately, the students are caught up in that process right now, and we are trying to accommodate students so they can continue their spring semester and not get dropped from their courses.â€

UofM enrollment services counselor ShaRhonda Williams is aware of the impact the government shutdown has on students who planned to receive IRS documents.

“The government shutdown affected our students because they’re not able to contact the IRS if they’re selected for verification,“ Williams said. “Verification is a process that requires you to submit a worksheet and also your tax return transcript.â€

On Jan. 9, the U.S. Department of Education announced alternative forms of verification for students who are unable to provide IRS documents.

For students who filled out an income tax return — a signed copy of the 2016 income tax return, as applicable, that the tax filer submitted to the IRS or other tax authorities to verify FAFSA/ISIR income and tax return information will be accepted. A tax preparer stamp is also acceptable. Handwritten tax returns will not be accepted.

Students who did not file taxes or that have parents who did not file tax returns, do not have to complete a form for the applicable tax year.

Nontax filers have to submit a statement verifying that the student attempted to obtain the VNF from the IRS or other tax authorities and was unable to obtain the required documentation and has not filed and is not required to file a 2016 tax income return or that the student has a copy of an IRS form W-2, or an equivalent document, for each source of 2016 employment income received by the individual.